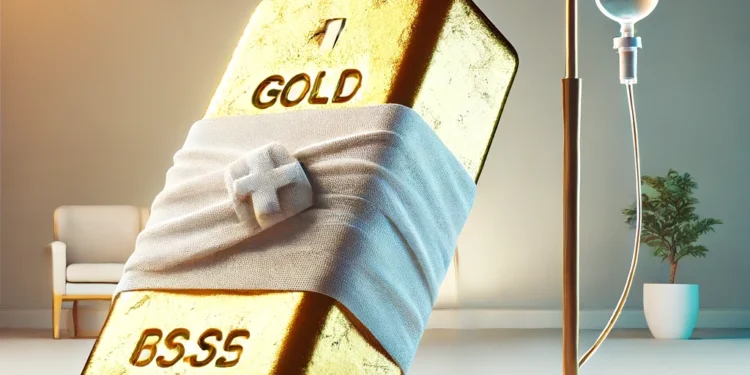

Gold’s Resurgence: Analyzing Its Financial Recovery

Introduction

In the dynamic realm of financial markets, gold has historically stood as a beacon of stability and a hedge against economic uncertainty. Recently, gold has shown signs of a significant recovery, regaining its luster after periods of stagnation and decline. This resurgence is particularly noteworthy in the current global economic climate, characterized by volatility in traditional financial instruments and currencies. This article delves into the factors driving gold’s recovery, its implications for investors, and the broader economic landscape. We will explore the inherent characteristics of gold that endear it to investors, especially during turbulent times, and discuss the potential future trajectory of its value.

Factors Fueling Gold’s Recovery

Gold’s recovery can be attributed to several key factors that underscore its role as a “safe haven” asset. Primarily, the resurgence is driven by:

- Economic Uncertainty: Amidst uncertainties such as trade wars, geopolitical tensions, and disruptions like the COVID-19 pandemic, investors increasingly turn to gold. Its intrinsic value is not tied to any particular country’s economy, making it less susceptible to economic downturns.

- Inflation Fears: With major economies deploying large-scale stimulus measures to combat the economic fallout from global crises, there are growing concerns about inflation. Gold is traditionally viewed as an effective hedge against inflation, as its value is perceived as being less likely to erode compared to fiat currencies.

- Currency Fluctuations: The weakening of the US dollar against other major currencies often results in higher gold prices, as gold becomes cheaper for investors holding other currencies.

These factors combine to bolster investor confidence in gold, driving up its price and prominence as part of a diversified investment portfolio.

Implications of Gold’s Recovery for Investors

The recovery of gold prices has several implications for both individual and institutional investors:

- Portfolio Diversification: Gold is a valuable asset for diversification. Its price generally moves independently of other assets like stocks or bonds, providing a balance in mixed asset portfolios, which can reduce overall volatility.

- Risk Management: By investing in gold, individuals and entities can manage risks more effectively, especially during times of financial instability. Its reputation as a safe haven makes it a preferable choice for preserving capital.

- Retirement Security: For long-term investors, such as those planning for retirement, gold offers a reliable investment that has historically maintained or increased its value over time.

Pros and Cons of Investing in Gold

While the investment in gold offers several benefits, there are also drawbacks to consider:

Pros:

- Stability: Gold has maintained its value over the centuries and is less volatile during economic downturns than many other assets.

- Liquidity: Gold is highly liquid; it can be bought and sold relatively easily due to its high demand across global markets.

- Universal Value: Gold holds universal appeal and retains value across geopolitical borders, making it a global standard in wealth preservation.

Cons:

- Storage and Insurance Costs: Physical gold requires secure storage and insurance, incurring additional costs for investors.

- No Yield: Unlike stocks or bonds, gold does not produce income through dividends or interest, which may make it less attractive during stable economic times.

- Market Timing Difficulty: Predicting the best times to buy or sell gold can be challenging due to its many influencers, including geopolitical events and macroeconomic variables.

Conclusion

As gold continues to recover, its role in the financial markets remains as relevant as ever. For investors seeking stability and security in an uncertain economic environment, gold offers a compelling choice, albeit with certain caveats. The ongoing global economic situation, characterized by uncertainty and market fluctuations, likely means that gold will continue to be a key player in the investment landscape. For those looking to safeguard their investments or diversify their portfolios, understanding the dynamics of gold is crucial. As always, the decision to invest in gold should be made with careful consideration of one’s financial goals and taking into account the potential risks and rewards. Gold’s enduring legacy and recent performance underscore its significance in a balanced and strategic approach to investing.

The Next Crash: What Would Happen?

The Next Crash: What Would Happen?

Market Updates

Market Updates

Trump’s Win and Bitcoin’s Rise

Trump’s Win and Bitcoin’s Rise

The UK Market!

The UK Market!  Forex?

Forex?

: How Analytics Offers a Competitive Edge in Trading

: How Analytics Offers a Competitive Edge in Trading

Master the Art of Risk Management: Protect Your Trades, Grow Your Profits!

Master the Art of Risk Management: Protect Your Trades, Grow Your Profits!

Mastering Swing Trading: Ride the Market’s Waves Like a Pro!

Mastering Swing Trading: Ride the Market’s Waves Like a Pro!